THE WORLD BANK “ Turkiye is Bracing for a Bumpy Road”

THE WORLD BANK “ Turkiye is Bracing for a Bumpy Road”

ANATOLIA REPORT

June 2022

“Several risks can affect the path of economic growth and poverty”

According to the World Bank , “Turkey Economic Monitor 2022” report, Turkey’s economic growth outlook is affected by ongoing macro-financial conditions, following very high growth in 2021.

Economic growth is expected to moderate to 2.0 percent 2022 but assumes appropriate restraints on both monetary and fiscal policy and prudent financial sector policies. Risks to growth are tilted to the downside in 2022. Regional vaccine challenges may undermine good vaccine progress to date. The recent emergence of Omicron further underscores the importance of vaccination and boosters. Continued Lira depreciation and high inflation may further exacerbate macro financial vulnerabilities, erode real incomes, distort price signals, disrupt production and supply channels, and stress corporate and banking balance sheets. High inflation also poses a risk to Turkey’s progress on poverty reduction.

Macroeconomic policy settings should adjust to boost confidence and mitigate macro financial risks. Tight monetary policy effort is warranted to restore confidence in monetary policy and anchor inflation expectations. The fiscal impact of recent deposit guarantee scheme to reverse dollarization and other fiscal risks should be closely monitored. Strengthening insolvency and debt resolution frameworks will be important to de-risk the corporate and financial sectors. To support Turkey’s growth potential, ensuring macroeconomic stability and a predictable regulatory environment will help attract more and high-quality foreign direct investment and boost productivity and high-tech exports. Taking measures now to adapt to the EU carbon border adjustment mechanism will also help Turkey to boost exports and remain competitive in the EU market.

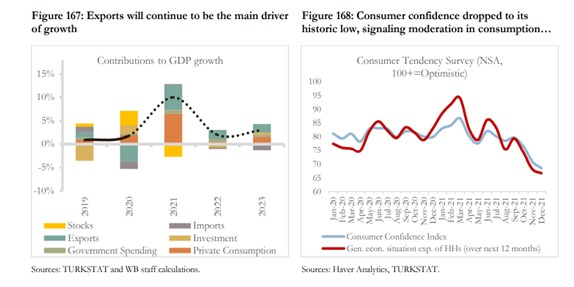

Economic growth is expected to be significantly lower in 2022 than 2021. While GDP growth in 2021 is expected to reach 10.0 percent, with upside risks, momentum is expected to have waned in Q4 2021 as macro[1]financial turbulence intensifies. This turbulence combined with the high base effect of growth in 2021 will drive the decline in growth next year. Growth is expected to decline to 2.0 percent in 2022 and recover slightly to 3.0 percent in 2023. These baseline projections assume neither severe COVID-19 restrictions in Turkey and its major export markets due to new variants, nor a disruptive macro-financial event. As in 2021, growth in 2022 is expected to be largely driven by continued strong growth in exports. The composition of growth is projected to continue shifting towards external demand. Net exports are projected to account for more than half of growth in 2021 (Figure 167). While external demand and price competitiveness due to the sharp depreciation of the Lira would fuel the expansion of exports, Turkey would also continue benefitting from the relocation of global supply chains, particularly in the EU market. This contribution of external demand is expected to rise, and net exports are expected to drive more than two thirds of growth in 2022, offsetting the drag in domestic demand from weak investment and high inflation. While the contribution of exports in 2021 was mostly driven by goods exports, a continued recovery in tourism activity is expected to increase its support to export and GDP growth in 2022, as pandemic related travel restrictions are further eased. The rise in exports coupled with sluggish import demand will help the current account deficit to narrow to 2.0 percent in 2021 and 2.6 percent in 2022. Real private consumption expenditure is expected to decelerate markedly in 2022. Private consumption growth will moderate in 2022 from the peak it reached in the first half of 2021. The consumer confidence survey in recent months signals the upcoming moderation in private consumption growth (Figure 168). Private consumption growth is forecasted to decline to 0.8 percent in 2022 from 11.0 percent in 2021. While the effect of pent-up demand on private consumption is expected to fade out, elevated inflation and high cost of borrowing will preclude strong private consumption growth. Employment and wages have started to pick up in the second half of 2021 from a low base. The minimum wage was raised by over 50 percent and wages of civil servants were increased by around 30 percent for 2022. The authorities took some actions (e.g. removal of income tax and stamp tax on the minimum wage) to reduce the burden of this increase on employers and mitigate possible adverse impact on employment. However, the cost for employers rose by around 40 percent, despite these measures. A downside risk that could further dampen consumption growth next year is that corporates could reduce their employment levels to compensate for high cost of production triggered by currency depreciation and spikes in the cost of personnel. Public consumption is projected to make a positive contribution to growth and to increase by 5.2 percent in 2021 and 4.5 percent and 3.3 percent in 2022 and 2023. The general government deficit is projected to widen to 4.6 percent in 2022 and 2023, largely driven by rising wage bills, interest expenses, and current transfers.

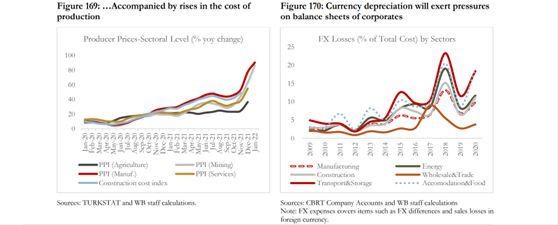

Corporate debt overhang coupled with high financing and operating costs, heightened macro[1]financial risks, and a depreciated Lira will be a drag on private investment in 2022. Sharp depreciations of the Lira impact Turkish corporates through several channels. First, corporates are already highly leveraged and run a substantial currency risk with around 60 percent of their loans being denominated in FX. Lira depreciation exacerbates debt service difficulties and weakens the balance sheet of domestic corporates. Currency mismatches are common in many sectors. Sectors like construction and utilities that do not have FX hedges against exchange rate movements are more vulnerable. Over the last 3 years, the share of FX losses in total costs of corporates increased sharply due to depreciation, particularly in vulnerable sectors (Figure 170). Second, sharp depreciation of the Lira coupled with a surge in international energy prices led to a spike in production costs in almost all sectors (Figure 169). Lastly, due to deterioration of inflation expectations, heightened risk premium and global tightening prospects, the cost of borrowing for corporates is likely to remain high despite domestic monetary easing. Personnel cost and raw materials, much of which is imported, represent the largest costs to corporates. Recent increase in the minimum wage will lead to an increase in cost of employment by around 40 percent in 2022. Given the pressure on balance sheets coupled with a high degree of uncertainty, corporates are more likely to alleviate cash shortages than expand capacity. Therefore, investment is expected to record a contraction of 3.0 percent in 2022, followed by a modest rebound of 2.2 percent in 2023. On the production side, GDP growth is expected to be driven increasingly by the services sector. With the acceleration of vaccine rollouts, a more pronounced medium-term rebound is projected in the services sector, including the tourism sector. The services sector will generate around two thirds of growth in 2022. The industrial sector, on the other hand, is expected to grow by 1.5 percent in 2022 due to a high base effect and supply-side frictions driven by heightened price uncertainty. The agriculture sector is expected to grow below its long-term trend, at 0.7 percent and 2.0 percent in 2022 and 2023, respectively.

High and persistent inflation will be the main macroeconomic challenge in the medium-term. Amid market interpretation over the future direction and objective of monetary policy, including the weight it puts on controlling inflation, market-based inflation expectations rose sharply from around 13 percent in early 2021 to around 41 percent in early 2022. Exchange rate pass through, high inflation expectations, global price pressures and substantial tax and wage adjustments are expected to keep inflation elevated in the medium term. Inflation is projected to accelerate further to 47 percent in 2022 in an environment of a loose monetary policy stance. Risks on inflation for 2022 are tilted to the downside. Efforts to tighten monetary policy and enhance monetary policy credibility are important to contain the pressure on the Lira and stabilize inflation expectations.

There is considerable uncertainty over the baseline forecast, with risks heavily tilted to the downside. External risks are balanced, with the upside of a quicker-than-expected recovery in global demand countered by continuing supply chain constraints and potential global financial market disruptions caused by faster than expected normalization of monetary policy in advanced economies. However, on the domestic side downside risks dominate. The continuation of loose monetary policy in Turkey may have negative effects on both domestic and foreign investor confidence, heighten market volatility, increase risk premia, and threaten macro[1]financial stability. In addition, the introduction of the local currency deposit protection guarantee against the currency depreciation provided by the Ministry of Treasury and Finance in December 2021 appears to have helped stabilize the exchange rate. On the other hand, it might have adverse consequences on budget balances, and fiscal space. Supply-side constraints are already emerging, as the sharp depreciation of the Lira and the attendant uncertainty around imported intermediate goods prices disrupts procurement at the same time as consumption and investment slows. While the banking sector remains highly capitalized and with adequate foreign exchange buffers, recent macro-financial instability would put further pressure on banks’ balance sheets. Further deterioration in macro financial conditions may dislodge the fiscal anchor and leave less space for countercyclical fiscal policy. Risks also remain from climate change related adverse weather events, another global or domestic COVID-19 flare-up, and vaccine challenges that may delay vaccination progress.

Several risks can affect the path of economic growth and poverty

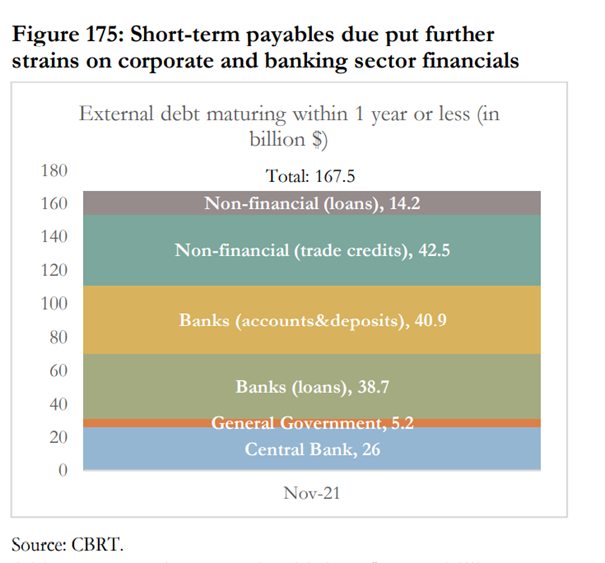

Given Turkey has high external financing needs and has been easing monetary policy while others have been tightening, an abrupt tightening of global financial condition can have significant negative effects on Turkey. Advanced and emerging economies have already started or indicated actively tightening their monetary policy stance amid rising inflationary pressures. The Fed has recently taken a more hawkish stance and signaled the prospect of three or four interest rates hikes in 2022. However, Turkey’s rate cuts since September 23rd have run counter to the  global trend. Real yields on Turkey’s debt are among the lowest in emerging markets. Turkey’s external balance sheet also remains vulnerable, given high external financing requirements and a reliance on portfolio flows rather than long-term finance like FDI 40. As of November 2021, external debt maturing within a year or less remains high at $167.5 billion, or 21 percent of GDP (including trade credits), largely belonging to banks and corporates (Figure 175).

global trend. Real yields on Turkey’s debt are among the lowest in emerging markets. Turkey’s external balance sheet also remains vulnerable, given high external financing requirements and a reliance on portfolio flows rather than long-term finance like FDI 40. As of November 2021, external debt maturing within a year or less remains high at $167.5 billion, or 21 percent of GDP (including trade credits), largely belonging to banks and corporates (Figure 175).

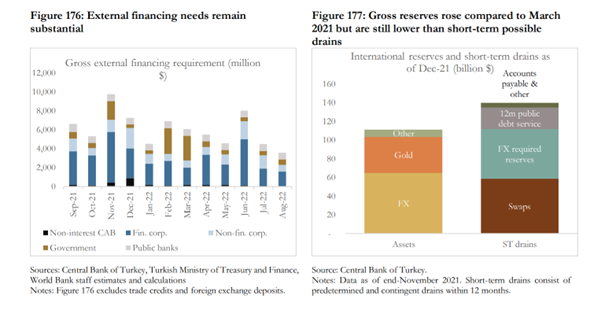

Turkey’s credit default swap (CDS) spreads have risen to record high levels and spreads on government securities and corporate Eurobonds may extend further as global liquidity conditions tighten. A faster than expected tightening of monetary policy in advanced economies may result in a sharp tightening of Turkey’s financing conditions, adversely affecting capital flows, and exacerbating refinancing risks. Monthly external payment obligations are manageable but prone to risks. The average monthly Gross external financing requirement (GEFR) is expected to decline to $5.4 billion in 2022 relative to the average of $7 billion in 2021 thanks to declining repayments of public and private institutions. (Figure 176) However, GEFR will be high again in June 2022 due to the repayment of financial corporations. Financial corporations are expected to account for 48 percent of total external financing needs in the next 12 months. Under normal market conditions, a large proportion of debt maturing is rolled over, resulting in a much lower net external financing requirement. In addition, gross reserves went up to $111.2 billion in December 2021 compared to $86.7 billion in March 2021, improving the external buffer. However foreign exchange interventions to defend the Lira that started in December for the first time since 2014 may erode this buffer. Furthermore, gross reserves cover only 70 percent of short-term external debt on a remaining maturity basis. Should market sentiment deteriorate when large external repayments are due, then Turkey may face refinancing risk, triggering external volatility. Volatility may be exacerbated by high level of short-term FX drains, such as CBRT swaps in gross reserves and FX required reserves, by a surge in rollover costs due to global liquidity tightening, and the high-risk premia of Turkey (Figure 177). Volatility unleashed by monetary policy actions adversely impacted corporate and banking sector balance sheets, exacerbating the risk of debt repayments and disruptive external adjustments. As noted, the banking sector, which dominates financial corporations, is expected to account for the majority of external financing needs over the next 12 months. On the other hand, the banking sector in Turkey has shown resilience, including an ability to hold enough foreign currency liquidity to meet its short-term FX debt, despite financial market stress over the last 3 years. However, the banking sector’s buffers have recently declined. The sector is vulnerable to exchange-rate depreciation due to the impact on capitalization, asset quality, refinancing risk, and high deposit dollarization. Similarly, corporate distress remains high, and further depreciation is likely.

to put more pressure on already stretched balance sheets of corporates, particularly the highly FX leveraged ones with less FX buffers. The net FX position of corporates remained high in October at $116.4 billion, despite some improvements since the 2018 currency shock. Sustained currency depreciation coupled with a decline in economic activity and stagnant profits could lead to a wave of restructurings and bankruptcies. And this could have a spillover impact on the banking sector.

Persistent inflation poses risks to poverty Turkey has made considerable progress in reducing poverty, but the inflation outlook poses a risk to this.

The share of people below the $5.50 per day poverty line fell by three-quarters to 8.5 percent between 2002 and 2018. Double-digit inflation, economic volatility and the COVID-19 Pandemic have since set back poverty progress. The share of people below the $5.50 poverty line rose to 10.2 percent in 2019, and it is projected that the global pandemic pushed an additional 1.6 million below the poverty line in 2020 raising the poverty rate to 12.2 percent, totaling over 10 million poor people in Turkey. The projection that inflation (year average CPI) will accelerate to 29.5 percent in 2021, poses significant risks to progress on poverty reduction. Inflation does not affect everyone equally – the poor often bear the brunt of price rises. Households from the bottom decile allocate nearly 70 percent of their budget to food and housing, twice as much as the corresponding share for the typical household in the highest (10th) decile –and also well above the share for the median household (54 percent). Therefore, inflation episodes driven by fast price increases of food and housing expenditures have a higher burden for low-income households. When compared to households in the 10th decile, the annual inflation rate experienced by households in the 1st decile was higher in six out of the 10 years between 2011 and 2020. In 2019, for instance, the increases in food prices contributes 49 percent of the total inflation borne by families from the bottom decile, a share that drops to 33 percent and 18 percent for the median and wealthiest households, respectively. With food inflation above 40 percent year-on-year at the end of 2021, recent price developments have especially weakened the purchasing capacity of low-income households.

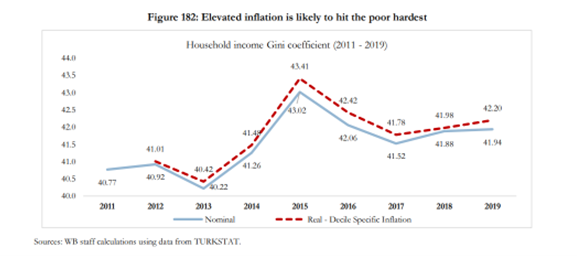

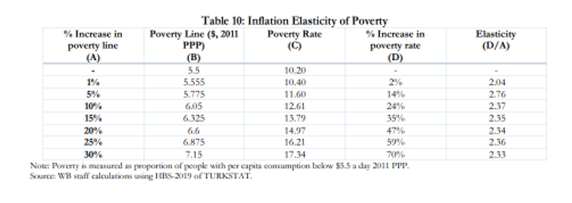

The heterogeneities in expenditures and price changes also have consequences on the measurement of poverty and inequality. In fact, elevated inflation is likely to affect the poor hardest, also with implications for inequality (Figure 182). The poverty rate in Turkey is highly sensitive to inflation in Turkey given the high concentration of people with incomes just above the poverty line. The value of the poverty line can be increased to mimic the effects of price increases on poverty in 2019, keeping everything else constant. Estimates of the elasticity of poverty to changes in inflation are high, ranging from 2.04 to 2.76, underscoring the high vulnerability of households to the negative effects of fast price increases on purchasing power. This is particularly true for families right above the poverty line when inflation is pushed by price hikes of food, non-alcoholic beverages, housing, education and health items. The average elasticity, 2.37, suggests that the poverty rate increases more than twice as fast as price increases that are not offset by income (labor and non-labor) growth or substitution of consumption (Table 10).